Insurance as an industry arose centuries ago from savvy data management and tracking. The exponential increase of data in our own century offers tremendous opportunity for insurers ready to think about Data-Driven Insurance.

Table of Contents

Insurance as an industry arose centuries ago from savvy data management and tracking. The exponential increase of data in our own century offers tremendous opportunity for insurers ready to think about Data-Driven Insurance.

We have never had as much data as we do today

By this time next year, the world’s data will have increased another 27% to 175 zettabytes of data. A third of that will be in real time via transactions, smart devices, and other online activity and interactions.

With such a mind-boggling amount of data, opportunities abound for insurers who can ingest, analyze, and act upon this information. This isn’t news to most in the industry: SwissRe reported that 92% of P&C insurers expect big data to generate significant improvements in their pricing, client experience, underwriting, and claims management.

Insurers’ Data Expertise Needs to Expand

Insurers are already experts at using data for product differentiation and pricing factors. You can bring that same level of expertise to engaging with your customers. This is the new frontier for data: strengthening your appeal to your prospects, agents, partners, and policyholders.

Historically, customer segmentation was limited to high-level demographic and firmographic information. External sources of data that can be married to existing data for drastically more detailed insights include:

- Pre- and post-purchase behavioral information and transactional data: profile attributes, payment timelines and methods, advance and deferred payments, app usage, social media activity, and other online behavior.

- External data: credit score and purchase history.

- Lifestyle data: occupation, physical activity, travel plans, extreme sports, etc.

- Firmographic data: type of organization, geographies served, number of clients, etc.

Holistic insights on prospects and customers empower insurers to:

- Personalize products and pricing, including bundled options.

- Craft targeted marketing messages and optimize customer journeys.

- Identify lucrative new market opportunities.

- Improve pricing accuracy.

- Boost customer retention rates.

- Optimize risk management and enhance overall profitability.

Data Empowers Digital Transactions

Today’s customers are tech-savvy and expect a seamless experience while doing business. This has profound implications for how insurers need to prioritize customer satisfaction in digital transaction journeys.

In addition, the expectations that customers bring from other industries affect their willingness to abandon traditional insurance companies altogether per 2021 research 2021 research from Accenture.

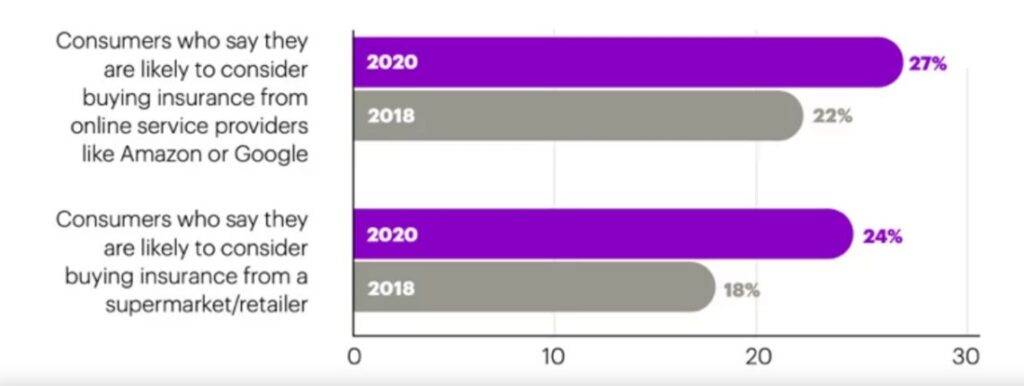

A comparison of consumer interest in insurance from supermarkets/retailers and online service providers like Amazon or Google over the years.

The digital experiences that customers value from these insurance outsiders are driven by external data.

The future of customer engagement lies in ditching the cookie-cutter approach to insurance sales by leveraging a variety of data. In an age where businesses are customizing all recommendations and products, clinging to generic solutions will leave your customers feeling ignored and unsatisfied.

Use Cases for Leveraging Data in Customer Experience

Enhancing how you engage with your customers through more personalized, data-driven experiences results in greater customer satisfaction and higher retention rates. The next question is where, exactly, do you start?

With such a diverse data landscape, the potential applications are boundless. We’ve outlined a few below that help bring customer experience into line with the expectations customers bring in from other industries.

Personalize and cross-sell insurance products

Many insurers already have plenty of experience offering tailored products and personalized risk advice in large commercial insurance transactions. The risks are so unique that there’s no mass market product available to satisfy the customer’s unique situation. A product is designed and delivered at the time of underwriting. Given the size of these transactions, insurance companies are compelled to deliver indemnity and non-indemnity-based solutions to differentiate themselves for larger customers.

Data helps insurers put these same mechanisms in place for smaller B2B and B2C insurance transactions. Consumers and companies who are segmented as mass-market risks tend to see commoditized products paired with mass-market, generic risk education.

This one-size-fits-all model is being tested as these customers are served tailored recommendations and products by businesses in other industries, such as retail. These customers are likely to demand similar treatment from insurers. Let’s face it, we all want to be classified as ourselves, not generalized as a market segment.

Insurers already have a ton of data pertaining to risk and claim experience. By combining this data with external sources of data including social, behavioral, transactional, and lifestyle, insurers gain a comprehensive understanding of their customers that allows them to personalize insurance products in a meaningful way. They could also bundle products dynamically and offer them as a package.

This approach enhances customer experience by communicating the message that they know customers’ risk intimately and have products and solutions to address their needs. They can also optimize risk education to what a specific customer actually needs.

For example, picture a new business owner looking to start their mobile pet grooming venture. When they seek an insurance quote online for a business owners policy, they receive a suggestion to also explore general liability and commercial auto coverage, considering they’ll be driving a grooming van. This tip comes as a surprise to the business owner, but it means they’re more likely to have the right coverage to protect their new business. The insurer also gains credibility as a partner in the customer’s overall risk management strategies.

Improve customer satisfaction, retention, and loyalty

Nearly 70% of consumers would share significant data on their health, exercise, and driving habits in exchange for lower prices from their insurers – an increase of 19% from two years ago, per the Accenture research cited above. Also, by collecting data on customers’ preferences, usage, transactional, and behavioral patterns, insurers can proactively identify emerging risks and help policyholders address them.

Continuous risk assessment builds a closer relationship between insurers and their customers. By engaging in ongoing communication, particularly during periods of heightened risk, insurers demonstrate their commitment to protecting policyholders and their assets.

Consider the case of an approaching tropical storm where insurers proactively reach out to policyholders through various channels—such as text, email, or calls—advising them to secure their vehicles in garages or avoid parking under trees. This proactive communication not only mitigates potential risks but also reinforces the insurer-customer relationship.

This is new territory for many insurers. Our industry has traditionally been more transactionally based: premium goes in, claims payments come out, and dense paperwork is generated at every stage.

An insurer who can help their customer avoid a claims payment through preventing damage to their car is in a very different relationship. They have become a trusted advisor on risk management, not merely a black box. This helps insurers move away from the traditional image of a transaction-based entity to a trusted partner, thus paving a path based on mutual benefit and understanding.

Business data shows that the cost of acquiring a new customer (individual and firm) is always higher than the cost of retaining one. Customer retention not only impacts the bottom line but also helps us improve word-of-mouth marketing, brand loyalty, referrals, NPS and others.

Strengthen your customer-centric brand

Analyzing customer and firm data parameters also gives insurers valuable insights for a deeper understanding of each client. Armed with these data points, they can identify tailored solutions to address process and service-related issues, anticipate additional upselling and cross-selling opportunities, and ultimately deliver a seamless and holistic customer experience.

Additionally, data can streamline marketing and communication efforts. By analyzing client engagement rates, insurers can optimize communication channels to maximize effectiveness. Furthermore, identifying the demographics of their target market with varying levels of engagement and preferred communication modes (phone, email, video call, etc.) allows for the development of relatable messaging and improved ease of doing business.

You Need the Right Tools to Deal With Data

Insurers need to invest in tools and technology that can intelligently source customer engagement, risk, and policy transactional data to convert them into actionable insights. These actionable insights can be delivered to insurance prospects and customers to help them better manage their risks. This needs to be performed at all stages of the customer’s lifecycle, from lead through loyalty.

Putting this data to work by leveraging a robust data platform can transform this data into powerful/actionable insights.

OwlSurance offers a modern data platform to help insurers do exactly that. You’ll find more information on the solution and our customer success stories on our website.