What happens when an MGA builds its entire data strategy around trust, governance, and accessibility from day one?

Table of Contents

In our recent Insurance Journal webinar, Falcon Risk Services pulled back the curtain on exactly that. Moderated by Jeff Goldberg, President of Goldberg Enterprises, the session featured Rich Pluschau, CIO at Falcon Risk Services, and Kiran Rangaswamy, SVP – Advanced Data Operations at OwlSurance Technologies. Together, they shared how Falcon developed Aerie, a modern data platform that has quickly become the organizational foundation for real-time decisions, predictive insights, and long-term scalability.

And it all started with a clear goal: create a single source of truth for the business.

Missed the session? Watch the full webinar here to dive deeper into Falcon’s data transformation story and the technologies powering it.

Why MGAs struggle with data

Jeff opened the discussion with a point that hits home for most MGAs: while everyone knows that data is important, actually using it well is where things get complicated.

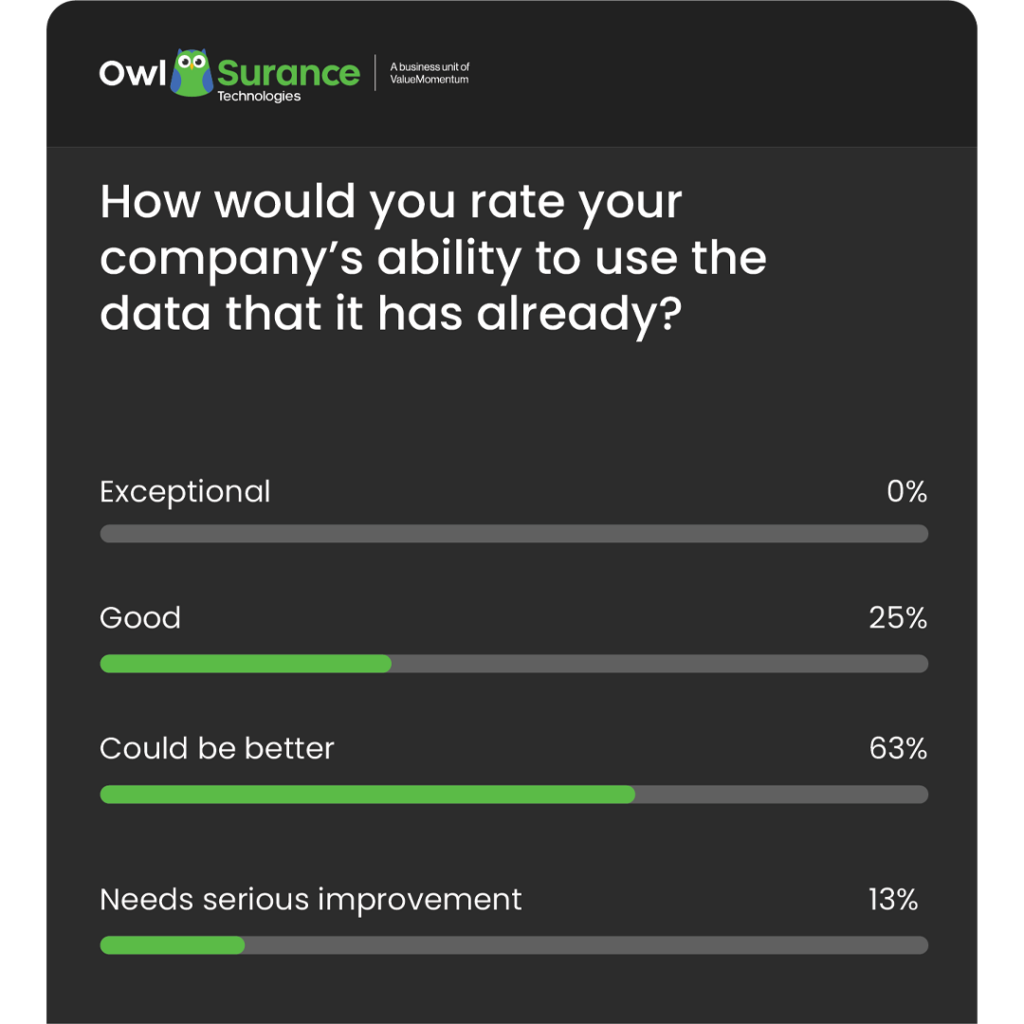

In fact, during a live poll conducted in the webinar, the majority of attendees rated their organization’s ability to use existing data as “could be better.” This shouldn’t come as a surprise. Most MGA operations function around manual processes and with systems built for compliance rather than business insights.

The result? Data scattered across systems, inconsistent standards, and analytics that cannot keep up with the pace of business decisions. And because MGAs typically operate with smaller IT budgets and complex partner dependencies, achieving data maturity can feel out of reach.

But Falcon saw things differently. Instead of retrofitting tools into legacy processes, they built from the ground up, with governance, scalability, and business alignment at the core.

Building for trust and scale from day one

Falcon’s journey began with a clear vision: data needed to be real-time, reliable, and embedded into business workflows – not isolated in spreadsheets or legacy systems.

“There’s a tremendous pride in underwriting discipline and a thirst for data driven analytical decision making, starting from the top all the way down”

Rich Pluschau, CIO, Falcon Risk Services

With OwlSurance as a strategic partner, Falcon built Aerie – a modern, cloud-native data platform (named after a falcon’s nest) designed to centralize, curate, and activate data across the enterprise.

What made Aerie different:

- A governed, unified data model with clear metadata and standards

- Real-time reporting and multi-day refresh cycles for operational decisions

- Embedded transparency with dashboards that include filter summaries and field definitions

- Recursive design – data from underwriting feeds modeling, which feeds future underwriting

In just a few months, Falcon went from no platform to 46+ dashboards, real-time analytics, and predictive modeling across core lines of business.

Co-creating the platform: insights from OwlSurance

One of the biggest factors in Falcon’s success was how they worked with OwlSurance. Instead of the typical vendor relationship, both companies treated this as a true partnership with shared responsibility for results.

Kiran Rangaswamy shared how the OwlSurance team worked closely with Falcon to rapidly build a scalable data foundation tailored to the needs of an ambitious, data-first MGA.

Kiran explained how OwlSurance helped design and implement the architecture by:

- Bringing in a global delivery team covering data engineering, BI, QA, and DevOps

- Integrating both internal systems (like policy and claims) and third-party external datasets, including Snowflake Marketplace sources

- Laying the foundation for master data management (MDM), predictive modeling, and GenAI use cases

- Building a semantic BI layer with reusable data models that enabled self-service analytics and rapid reporting across the business

By listening closely to Falcon’s goals and adjusting existing accelerators to fit, the OwlSurance team helped convert Falcon’s clean-slate opportunity into a real, repeatable data advantage.

“This wasn’t about deploying dashboards. It was about enabling smarter, faster decisions at every level of the business,” Kiran Rangaswamy

From data to intelligence

Aerie’s value shows up in everyday operations across Falcon’s business:

- Automated submission intake: Using AI to convert third-party carrier forms into Falcon-standard formats

- Accounts Like Mine: A tool that lets underwriters evaluate similar risks based on historical data and outcomes

- Loss data analytics: Which help connect claims activity to specific policy language

- Rating data capture: Storing every quote (even those not bound) for future actuarial modeling and pricing refinement

These capabilities allow Falcon to operate with greater accuracy, speed, and insight – outpacing their competitors by miles.

Lessons for Other MGAs

Falcon’s transformation offers some key takeaways for other MGAs thinking about their data transformation journey:

- Start with governance. Clean data is valuable data. Invest in structure before scale.

- Think in systems, not silos. Recursive data loops fuel better performance across underwriting, modeling, and pricing.

- Choose partners, not vendors. Collaboration – not just software – made Falcon’s success possible.

And you do not need a massive internal IT team. With the right cloud tools and the right partners, even lean teams can build enterprise-grade capabilities.

Turning a Data Vision into Real-World Results

Falcon Risk’s journey proves that modern data transformation does not require massive teams or endless budgets. It requires clarity of purpose, strong governance, and the right strategic partners.

By prioritizing clean, connected, and real-time data from the start, Falcon has positioned itself not just to grow, but to lead. From underwriting intelligence to AI-powered operations, the value of a trusted data foundation is already paying off, and the road ahead is full of possibilities.

Want to see how it all came together? Watch the full webinar here or get in touch with the OwlSurance team to explore how we can help you start your own transformation journey.